Originally published October 2017; updated to integrate Amazon’s acquisition of One Medical

Anyone surprised that Amazon is buying a network of primary care clinics is misreading the $20 trillion shift happening in healthcare worldwide. All the money is moving to a new form of competition based on outcomes delivered through a consumer-grade experience.

The industry re-organization is happening in different ways and at different rates in different markets. But it has progressed to the point where the global trend is clear and rapidly accelerating: the center-of-gravity for health system strategy is on entirely new value propositions and enabling (if not guaranteeing) better outcomes.

Winners will be those who can navigate this transition space with leadership and a superior understanding of ecosystem-centered market strategies, at scale.

In 2017, Apple considered the same sort of move. In breaking the news about Apple, CNBC said the discussions about expanding into primary care had been happening inside Apple's health team for more than a year (here's the link: Apple explored buying a medical-clinic start-up as part of a bigger push into health care). CEO Tim Cook had previously said health is a major business opportunity for Apple, although "most analysts believed he was talking about how the iPhone and Apple Watch might monitor people's health," according to BusinessInsider.

The allure of the gadgets is hard to resist.

The analysts are working with an under-conceptualized view of the flux, and perpetual remixing, shaping new industry models. The focus tends to be almost excessively on the functional attributes of the technology.

Missing from the conventional perspective is understanding that pieces matter less than the whole, "things" are secondary to experiences. The new business value to extract from healthcare is not from the discrete use of iPhone applications or the Apple Watch, but the way these components can meld together to interact and form a broader architecture for managing information.

A Dominant Design for Healthcare Delivery

Amazon (and Apple) is an infrastructural technology. It looks set to become the dominant design for healthcare delivery in the United States, the backbone to match clinical outcomes with business and administrative processes.

To put it another way, Amazon has solved for ‘market interoperability’ at a national level. It is one or two acquisitions away from becoming its own health system.

Its deal with health insurer Aetna to bring the Apple Watch to Aetna’s 23 million members as a free perk is one example of how it's strengthening its position, embedding iOS deeper within the bedrock and locking-in a kinetic advantage. In so doing, it has elevated the concept of a 'consumer-grade experience' as a standard, one on par with keeping HbA1c levels below 7 for someone with diabetes.

The price of admission to play in the next healthcare will be connecting to this new standard. In other words, the magic leap to new value will be according to the rules of Apple.

Our brains, the neural engines of the mind, will have to work with a new frame around the new world we're encountering. The ecology of mentally processing a complicated zoo of interaction requires a different lens:

Seeing technology as a form of biology. "We are morphing so fast that our ability to invent new things outpaces the rate we can civilize them," says Kevin Kelly, the visionary thinker and founder of Wired who foresaw the scope of the internet revolution. We're less multichannel than infinite channel. All things being equal, the physics that govern the dynamics of technology creation outweigh the specific features of a piece of technology, or the particular instances in which it gets used.

Making agility a strategic imperative. Adapting to the disruptions of modernity rides on an operating model that is agile, one that is capable of managing a circular expansion of both problems and solutions as a living, breathing thing. Patience is needed to reward and nurture a steady accumulation of small net benefits over time.

Positioning 'human-centered design' as the interface to engage with people formerly known as target audiences.

IDEO describes human-centered design as a creative approach to problem solving that starts with the people you're designing for, and ends with new solutions that are tailor-made to suit their needs.

This is a space with new anchors of meaning: patients as doctors, doctors as consumers, customers as competitors, and competitors as collaborators. We've spent billions to fix our medical records, and they're still a mess. The reason why is because Epic and Cerner did not know or understand the importance of 'human-centered' as fundamental point (for more context, see here: AMA demands EHR overhaul, calls them 'poorly designed and implemented').

Looking beyond the clinical setting to improve outcomes. More than 2 billion people worldwide are overweight or obese (reference here); more than 400 million people worldwide have diabetes. The next design frontier is less connected health, more distributed health. It's about dissolving boundaries between pieces -- market, industry, technology -- to continuously deliver against a unique patient-to-consumer-to-patient-to-consumer loop. Says Chris Lawer, Founder and CEO at Umio:

"Value is increasingly sourced in adjacent-to-clinical "social" ecosystems. Most health tech companies are searching in the wrong forest for growth opportunities."

Becoming the authoritative source of a particular kind of information. As more and more data (and data providers) flood the market, a competitive position based solely on data becomes impossible to defend. Specialized cognition, superior insight into how to manage unique sub-populations (say the 'diabetic asthmatic'), or inventing entirely new standards of care (see here for Shire in hemophilia), is a leverageable and sustainable advantage.

Power flows from discovery, not distribution.

There are multiple billion-dollar business models and markets to develop based on improving outcomes and squeezing inefficiency from healthcare. The path to get there is to make technology so immersive that it disappears into the experience. Competition is about creating and managing new systems of engagement.

The 'Amazon Way of Strategy'

Amazon is not an e-commerce company.

It's now a foregone conclusion that Amazon is entering the healthcare sector. Every other day there is another article (including this one) on how they're planning to dominate some new corner of the American economy.

Amazon has said it is preparing to make two very big decisions public. The first is whether or not it will get into healthcare, to be announced, supposedly, sometime around Thanksgiving. (The second is where it will locate its second world headquarters.)

While the investment bankers at Leerink predict the "disruptive potential posed by Amazon will be across the multi-billion dollar pharmacy benefits arena," what if Amazon really wanted to go all in? What might that look like?

Could Amazon become a payer, dis-intermediating the likes of Cigna and Anthem with its health infrastructure? Could it become a provider, like Apple considered? It's not beyond the realm.

The health plan industry's worst nightmare is employers realizing they are actually the insurance company. Dave Chase argues that any company over 100 employees or so is an insurance company in all but name, and asks "what do health plans do that couldn't be done better by an algorithm?"

DJ Wilson, President and CEO of State of Reform, a stakeholder-driven initiative that tries to bridge the gap between the worlds of health care and policy, explored the concept of Amazon-as-health-insurance-company last month in a provocative blog. In The 8 steps to Amazon entering the health market, he writes:

"Amazon looks for industries that are not sensitive to the customer, that have profits or premium pricing based on barriers to entry (often capital related), and looks to exploit those opportunities. It’s pretty straight forward. And, whether that industry is cloud storage space or groceries or “last mile” distribution networks, Amazon is thinking about it."

He goes further, suggesting that Amazon already provides health insurance benefits to almost 500,000 employees: 390,000 or so at Amazon, and 90,000 or so at Whole Foods. They also cover some number of employee dependents. If you count that total number of lives, they immediately become one of the largest health plans on the west coast.

An "Amazon Strategy" is very simple: it's about finding and reducing friction in a system.

Like Apple, it means organizing technology delivery around people, not people around technology. Add-in unique capabilities in delivering quality, cost transparency, customer reviews, hyper-personalization, and lowering costs, and it's easy to see the roadmap.

And if Amazon can buy Whole Foods, it can buy a network of urgent care centers, or primary care providers. There are a number of them out there that would jump at that chance.

The New Standard: A ‘Consumer-Grade Experience’

Apple and Amazon have taken two paths to the same conclusion: as health care costs rise, and as consumers are forced to shoulder more of the burden for their care, convenience, transparency and a personalized experience are new forces emerging from the environment that are driving health system transformation.

Consumers' mounting cost burden affects both employers and employees, as a growing portion of each company’s bottom line and employee income goes to health care.

Eight years into healthcare reform, high-deductible health plans have become the norm. According to the Kaiser Family Foundation, 51 percent of employee-sponsored health plans have annual deductibles of $1,000 or more. Two-thirds of plans on health exchanges have deductibles that exceed $3,500 for individuals and $7,400 for families.

That dramatic shift in cost, from payers to consumers, is shifting patient behavior — and not always for the better, says Harvard economist David Cutler, senior healthcare advisor to the 2008 Obama presidential campaign and a member of the Massachusetts Health Policy Commission.

“People absolutely respond to the incentives in a high-deductible policy," Cutler says — but as they try to limit out-of-pocket costs, they often skimp on needed care. In turn, many health systems have had to change their own procedures and stare down the risk of bad debt.

It's a worldwide trend.

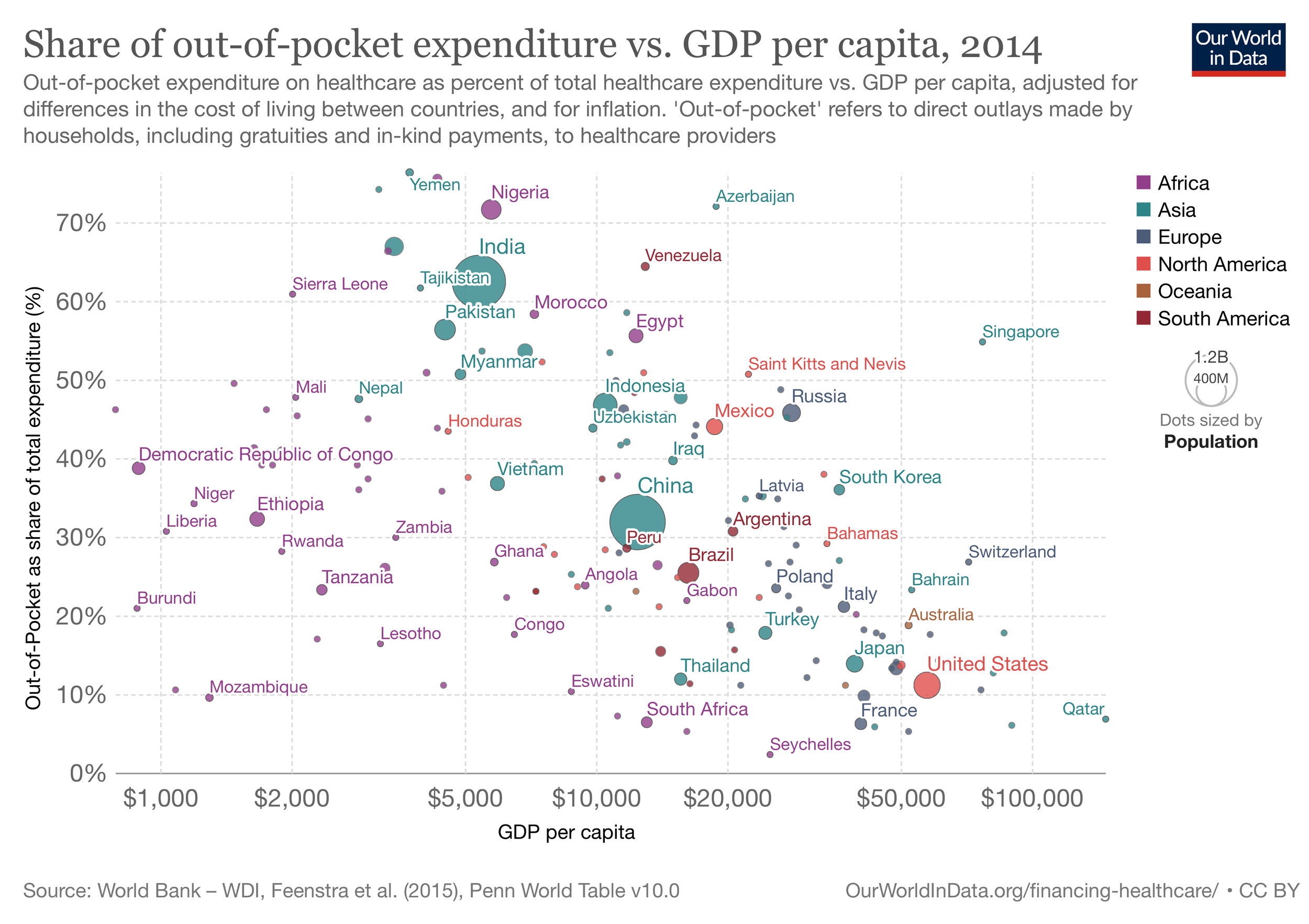

This relationship between income and reliance on out-of-pocket health expenditures is shown in the chart below. Here, we see the share of out-of-pocket expenditure as a percentage of total healthcare expenditure (on the y-axis) versus gross domestic product (GDP) per capita (which has been PPP-adjusted) on the x-axis.

It's not clear whether Apple would build out its own network of primary care clinics, in a similar manner to its highly successful retail stores, or simply partner with existing players. It's not clear if Amazon will buy or open its own brand of retail health stores. What is clear, though, is that quality and convenience -- a consumer-grade experience -- is shaping the new healthcare infrastructures.

Outcomes Over Inputs

Americans are retiring later, dying sooner and are sicker in-between.

Data released last week suggest Americans’ health is declining and millions of middle-age workers face the prospect of shorter, and less active, retirements than their parents enjoyed. Americans in their late 50s already have more serious health problems than people at the same ages did 10 to 15 years ago, according to the journal Health Affairs.

At the current retirement age of 66, a quarter of Americans age 58 to 60 rated themselves in “poor” or “fair” health. That’s up 2.6 points from the group who could retire with full benefits at 65, the Michigan researchers found.

Cognitive skills have also declined over time. For those with a retirement age of 66, 11 percent already had some kind of dementia or other cognitive decline at age 58 to 60, according to the study. That’s up from 9.5 percent of Americans just a few years older, with a retirement age between 65 and 66.

Read the full story from Bloomberg here.

Finding Strategic Fit

Yet in a style of thinking similar to the one used by analysts who were blindsided by Apple's potential (impending?) move into health delivery, there are many established players, like Walgreen's CEO Stefano Pessina, who believe healthcare is "too complicated for an e-commerce company like Amazon."

It's a serious misreading things.

Disruption is a clash between accelerating curves and our brain's wanting things to be linear. The problem with exponential systems is they catch us by surprise.

"And so institutions are doomed to be, always, in defense of whatever allowed them to be successful in the first place" -- Richard Normann, Reframing Business

In other words, if you don't like change, you're going to like irrelevance even less 🤘

/ jgs

John G. Singer is the Executive Director of Blue Spoon Consulting, a global leader in strategy and innovation at a system level. Blue Spoon was the first to apply system thinking to solve complex market access and integration challenges in the pharmaceutical industry.